Apple Pay's Continued Niche in Retail (and e-commerce to the rescue)

Apple Pay's retail presence isn't where you might think. Is that a problem?

Disclaimer that I'm a designer at NMI, a payment gateway who provides payments to over 250,000 merchants from one man shops to massive businesses. My employer does not know I'm writing this, all opinions are my own, and I'm not sharing any insider information. I'm merely hoping to provide some perspective from someone who works directly in this space.

A new PYMNTS study has some pretty doom-and-gloom news for Apple Pay:

Seven years post-launch, new PYMNTS data shows that 93.9% of consumers with Apple Pay activated on their iPhones do not use it in-store to pay for purchases.

For clarity, in the US retail world only (non-US and e-commerce are not counted here at all), only 6% of iPhone users who have Apple Pay on their phone use it to make retail purchases.

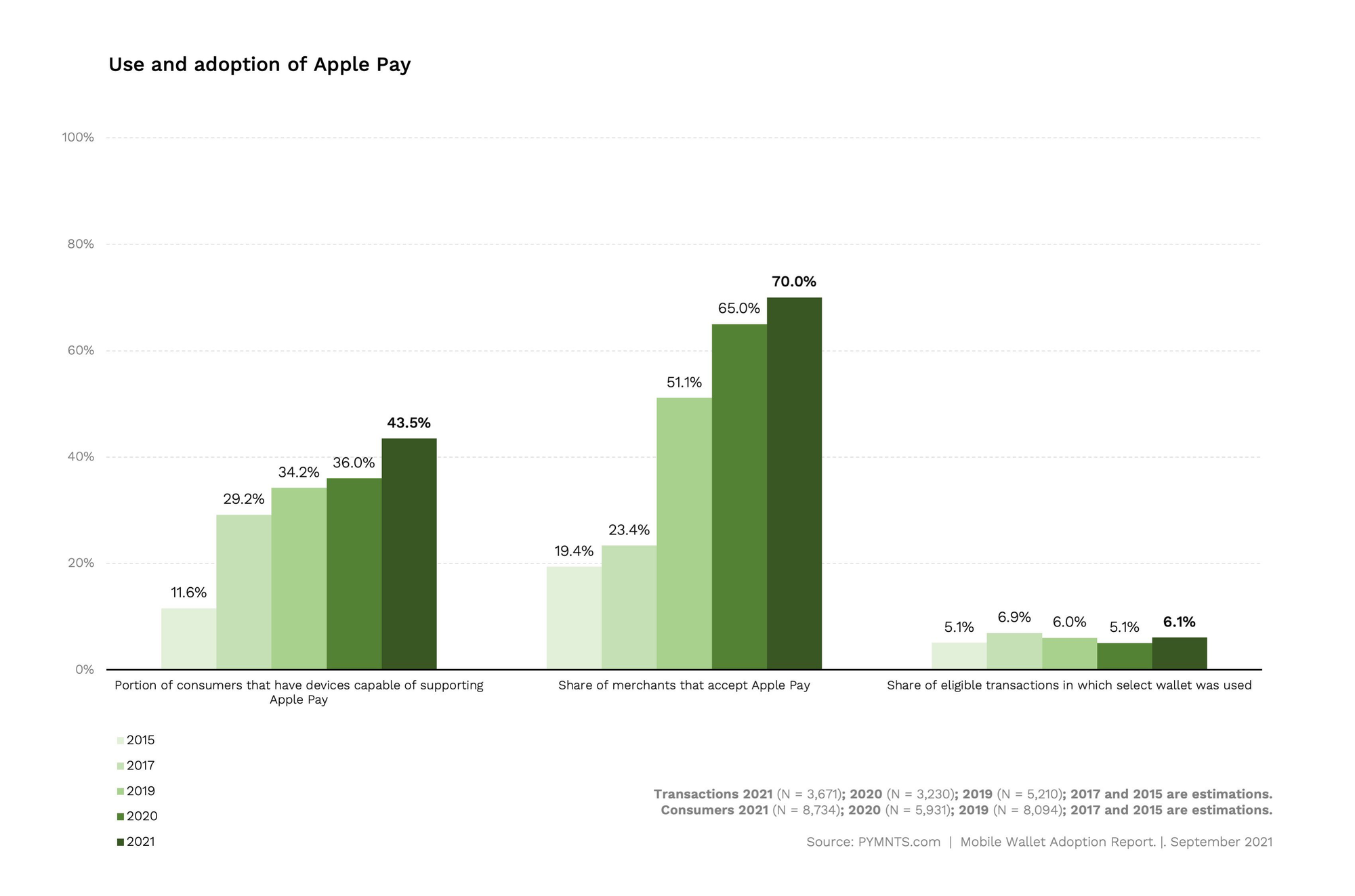

This chart particularly stood out to me:

So basically, since they started polling people in 2015 (Apple Pay launched 2014), the percentage of consumers with eligible devices is up 275%, the share of retail establishments with compatible hardware has gone up 260%, and the share of users using Apple Pay has gone up 19%. And with numbers this low, it's all basically hovering around the same margin of error.

Yikes.

I love Apple Pay, and I am decidedly in this 6% of users who use it in stores. Where I am, literally everyone seems to accept it, and literally the only time I have to get my physical card out these days is in restaurant situations where it's just not practical.

The challenge is persuading consumers that the value of Apple Pay is big enough to trade off the ubiquity and utility of the plastic card they know how to use, is accepted everywhere they shop, and doesn’t require using a particular device to pay for their purchase.

This resonates with me. People are just used to cards, and while we like contactless, once basically everyone was building NFC chips into their cards, the Apple Pay advantage shrunk. Again, I still think it's there, but if you have decades of habit-forming with using a card, then adding something to the current thing is less friction than asking you to use a whole new thing to make payments.

But this isn't the whole story (and PYMNT's apocalyptic headline obscures this).

E-commerce to the Rescue

Now the good news for digital wallets exists in the world of ecommerce. Here's FIS's Global Payments Report 2021, which addresses more than just the US.

Globally, usage of digital wallet-based transactions in 2020 grew 7 percent. By 2024, the report projects that digital wallets will account for more than half of all eCommerce payments worldwide.

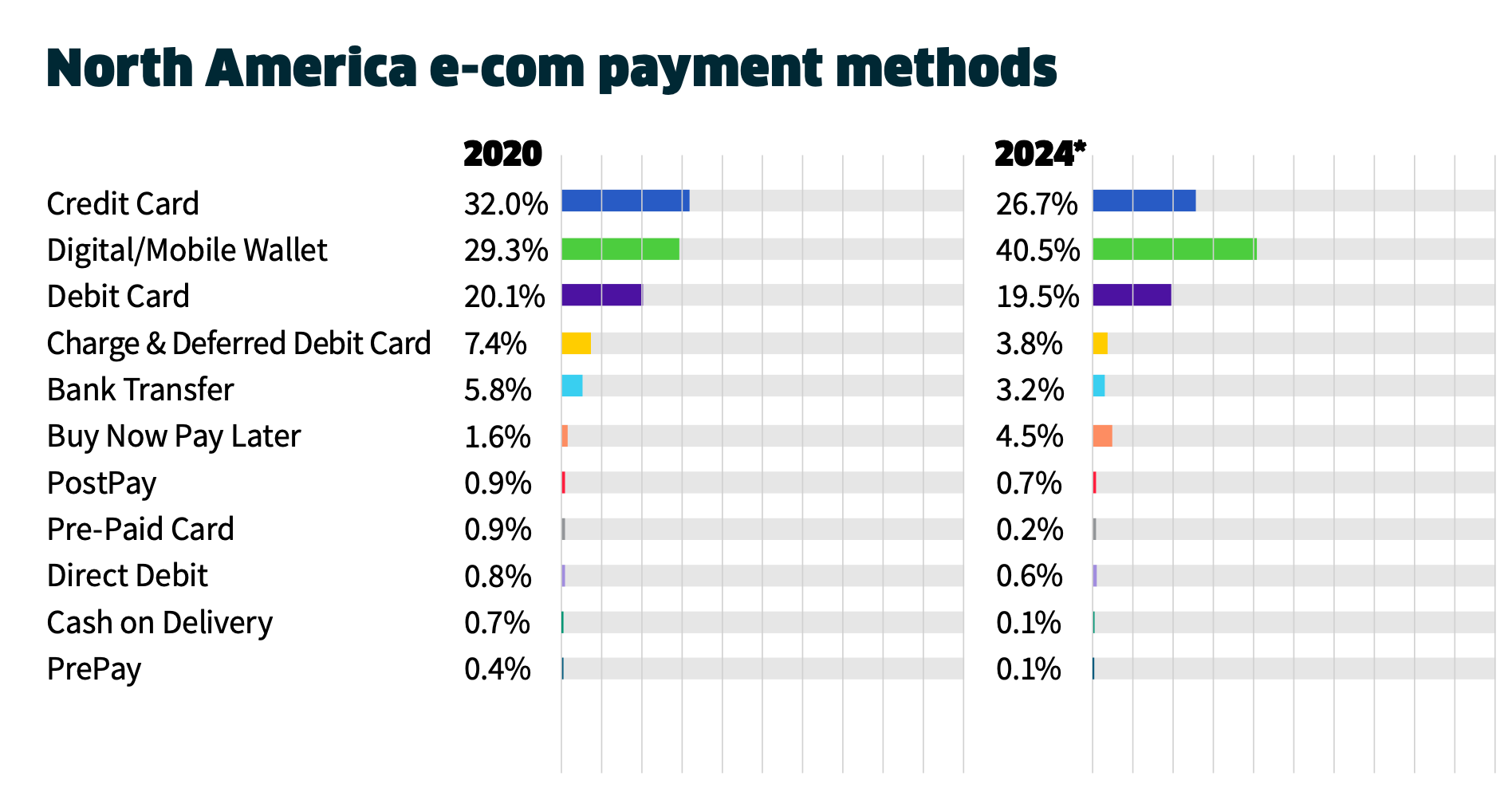

Well that's a rosier picture! Here's a chart from the report showing e-commerce usage across North America:

Keying in your card is still the most common method here, but it's shrinking (down 7% over 2019) as mobile wallets (up 23% YoY) and buy now pay later services (up 78% YoY) take its place. Of note, mobile wallets are already the most common e-com payment method worldwide with Asia and Europe using them way more than us.

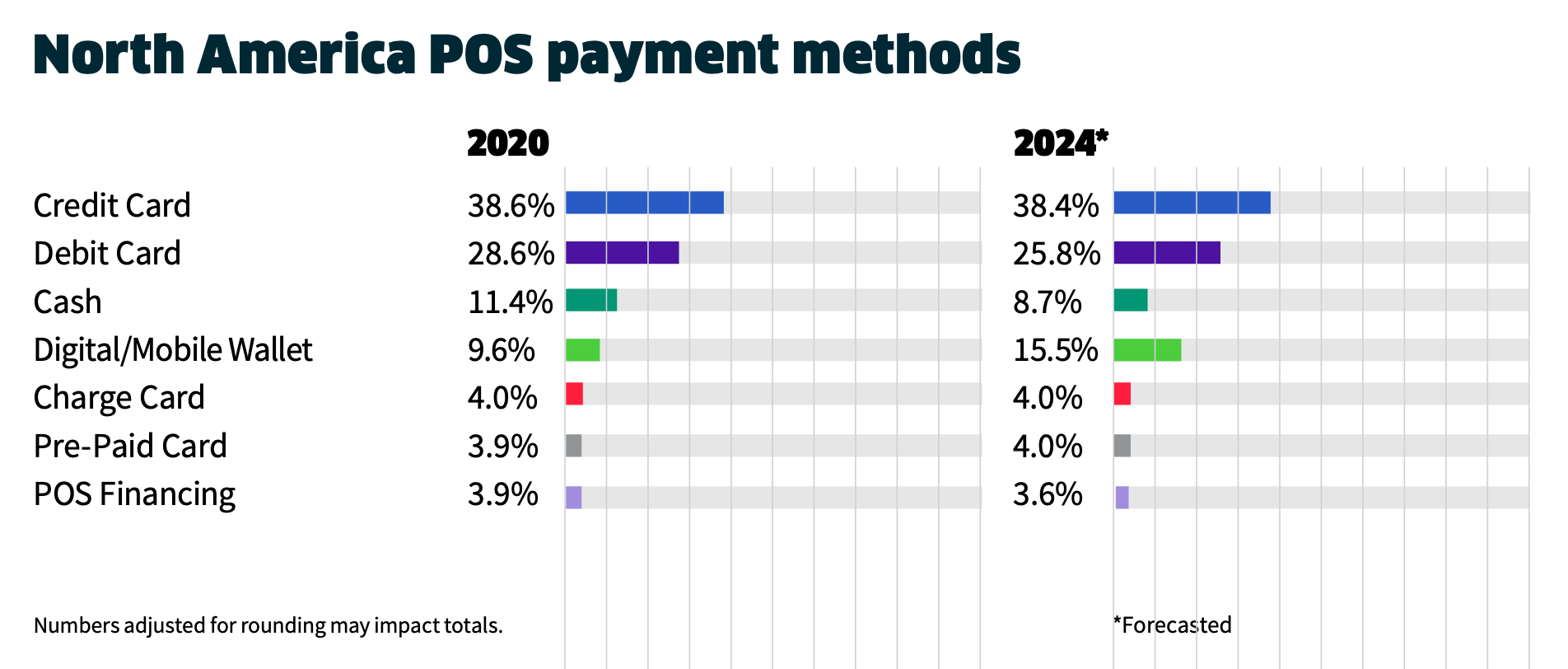

And if you were curious what FIS found for retail in North America:

Cards are still well over half of payments, but mobile wallets are on the rise. Maybe a slower rise than some of us would like, but on the rise all the same.

Now if we go back to the PYMNTS poll and compare that 6% number with the 9.6% mobile wallet share of all retail payments, we're actually not too far apart. Cut the number in half since iPhones account for a bit less than half of US phone activations and we've got about 3%, or about one third of mobile wallets. When we consider the FIS data includes Canada as well, and when we look at PYMNTS showing 45% of mobile wallet users were using Apple Pay, these reports really seem to be saying similar things. PYMNTS is pretty pessimistic, but FIS is reading this data much more optimistically.

Takeaway

In my opinion (again, not my employer's), Apple Pay is the king of mobile wallets here in the US. I'll actually hear the argument that Starbucks is the best, most used mobile wallet out there, but it's doing a different thing, in my opinion. That said, I think it's much more appealing to general users on the web than in retail situations. Retail feels pretty safe, and the convenience of tapping your phone vs your contactless card is not much for many. However, saving yourself from filling out a long form on a website vs tapping a single button is way easier and feels more secure (it is more secure, but the fact it feels it is essential for adoption).

I also think that digital wallets like Apple Pay have a steeper hill to climb in retail. A 50 year old has been paying for things basically the same way for their entire adult life, so changing their habits is not easy. E-commerce is no spring chicken, last year we did over $4 trillion in e-commerce as a planet after all, but it's much younger and the pace of innovation there is much greater so people are used to change and are more open to it. The biggest dig against e-commerce has always been security, and these digital wallets have the delightful advantage of both being easier to use as well as more secure.

Ultimately, I do know that the more options you give someone to make a payment, the more likely they are to make one, so I don't think mobile wallets are going to be won by any single provider, at least in the near term. I'd contend that this helps growth in e-commerce more than retail, as I can be an iPhone user who likes PayPal, and can choose between the Apple Pay, Google Pay, and PayPal buttons on a website to get the one I want. When I'm in a store though, my iPhone only allows me to use Apple Pay with contactless, so my options are more limited and I'm more likely to just opt for the tried and true card in my wallet.